Mahesh Roy

Investor Strategies Programme Director

An updated version of the Net Zero Investment Framework (NZIF) is now open for consultation until 24 April. NZIF has become the most widely used guidance by investors that have set voluntary net zero commitments since it was first released in 2021.

Informed by our members and supported by fellow networks in the USA, Asia and Oceania, ‘NZIF 2.0’ aims to make life easier for investors by bringing together the wide range of resources available to them all in one place.

Each element supports a unifying goal - to support real economy emissions reductions.

An evolution of the original framework, NZIF 2.0 incorporates some revised target terminology and criteria as well as updated guidance on asset classes. The resource also summarises best practices shared by investors, collected from three years of implementation, converting them into more than 40 potential actions an investor can take.

It references various supplementary guidance and tools which can support its use, designed to be a first port of call rather than a one-size-fits-all approach.

From the beginnings of setting a net zero strategy through to objectives and target setting, analysing asset classes to engaging with assets, information is now more accessible, intuitive and coherent in NZIF 2.0.

Targets 2.0

Longer-term users of NZIF will be familiar with its four targets and likely working towards one or more of them, with some investors having set all four. These remain largely unchanged in NZIF 2.0.

The portfolio decarbonisation reference target has been repositioned slightly to become an objective with a longer time horizon, designed to be used together with other targets in a ‘dashboard-style’ approach. This comes after our research discovered that, while useful in accounting and footprinting the carbon impact of a portfolio, ‘financed emissions’ targets used alone or primarily can have unintended consequences.

Investors discovered some of these inadvertent issues when addressing the target in the short term, such as avoiding investment in climate solutions, transition sectors and emerging markets, to reduce portfolio financed emissions. These investment themes often have higher upfront financed emissions but are nonetheless vital to reaching net zero by 2050. Mobilisation of capital towards them should be encouraged, not discouraged by targets.

This revised target emphasises the importance of assessing net zero targets over a longer period and including other accounting metrics alongside absolute emissions and financed emissions. Investors will also find explicit comments on scope three emissions at the portfolio level, drawing on our recent discussion paper on the topic.

The portfolio coverage target has been renamed the “asset alignment target” to better represent its recommendations and usage. There is also new potential for investors to use a percentage of financed emissions or a percentage of assets under management, to accommodate those focusing on high-impact sectors.

New asset classes

As well as recently released guidance on private equity and infrastructure, investors will find summaries of the latest guidance on sovereign bonds and real estate with new alignment criteria for both. Real estate investors will also find reference to our guidance on incorporating whole life carbon into assessments.

As private equity and infrastructure have recently been reviewed by working groups and public consultation prior to their release, they will not be open to further changes as part of this process.

Other notable improvements include new emissions performance criterion for listed equities and corporate fixed income, and new certificate deposits guidance to support net zero cash management.

NZIF 2.0 now offers guidance for most of the major asset classes in an average investor portfolio.

Mapping good ideas

We hope existing users of NZIF will welcome these updates, but it’s an evolution not a revolution, with no major conceptual differences on the whole. Instead, the team have focused on better communicating the resources available to investors.

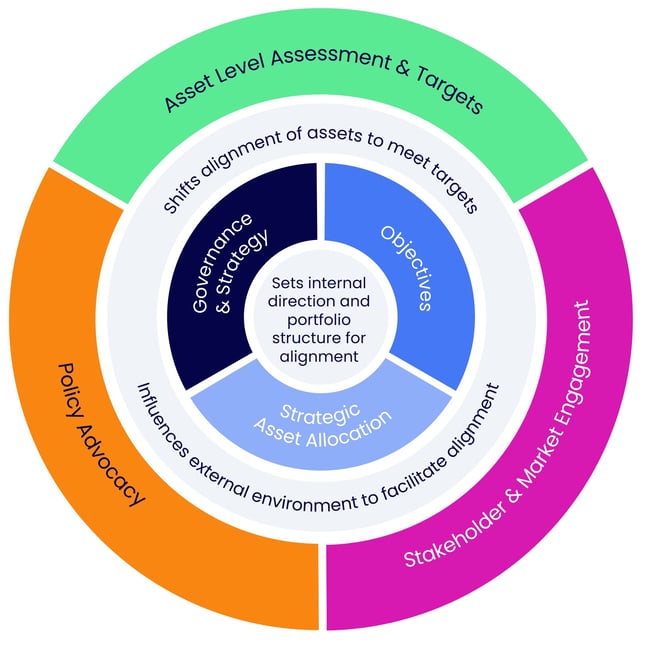

A new figure, the NZIF wheel (pictured) highlights the interconnected nature of each core area and their equal importance. It aims to show that net zero strategies are more likely to be effective if they address the external environment, which itself can either facilitate or inhibit investor activities. Each element interacts and there is no hierarchy.

Ultimately, an investor’s experience will vary based on their individual circumstances and strategies, but the wheel seeks to offer a visual representation of all the potential levers of change in one place. It remains each investor's decision to use the context-specific tools at their disposal to reduce emissions in the real economy.

NZIF 2.0 and much of our work at IIGCC aims to map all of these good ideas into one structure - a handbook of good ideas which supports investors, applicable to whichever regulations they operate under.

It’s here to make life easier for investors creating and implementing a net zero transition plan. A vital part of our work to bring the investment community together to work towards a climate resilient and net zero future.

If you’d like to take part in our working groups and help to shape the outputs of our resources, why not speak to our investor relations manager today to find out more about becoming a part of IIGCC?