Hugh Garnett

Investor Strategies Senior Specialist - Real Assets

Our new guidance offers a step-by-step for investors to consider whole life carbon emissions in net zero portfolios and decarbonisation strategies. It supports the Net Zero Investment Framework (NZIF) as well as other target-setting methodologies.

The real estate sector has one of the largest sectoral energy and carbon footprints, representing 37% of energy and process-related CO2 emissions and more than 34% of energy demand globally. Construction is also set to increase in the coming years to accommodate rising populations and improved living standards, particularly in developing economies.

This means that a more sustainable approach across the life cycle of a building, from construction materials to the in-life operations and end-of-life demolition or recycling of a building, is vital to achieving the goals of the Paris Agreement.

Knowledge in this space is developing, with more investors, businesses and regulators considering embodied carbon alongside operational emissions.

Our new guidance looks to strengthen this understanding by encouraging a whole life carbon (WLC) approach, supported by industry experts from the consulting, asset owner and asset manager space through our IIGCC real estate working group.

The first section outlines detailed methodologies and guidelines for assessing WLC emissions in the property lifecycle, including during production, construction, in-use and end-of-life stages, highlighting industry standards and an evolving regulatory landscape.

The second section provides guidance on the internal processes investors can implement at different elements within the life cycle to embed and standardise a WLC approach, including seven challenges to watch out for and rules to overcome them.

But first, what is a whole life carbon approach?

From plan to demolition

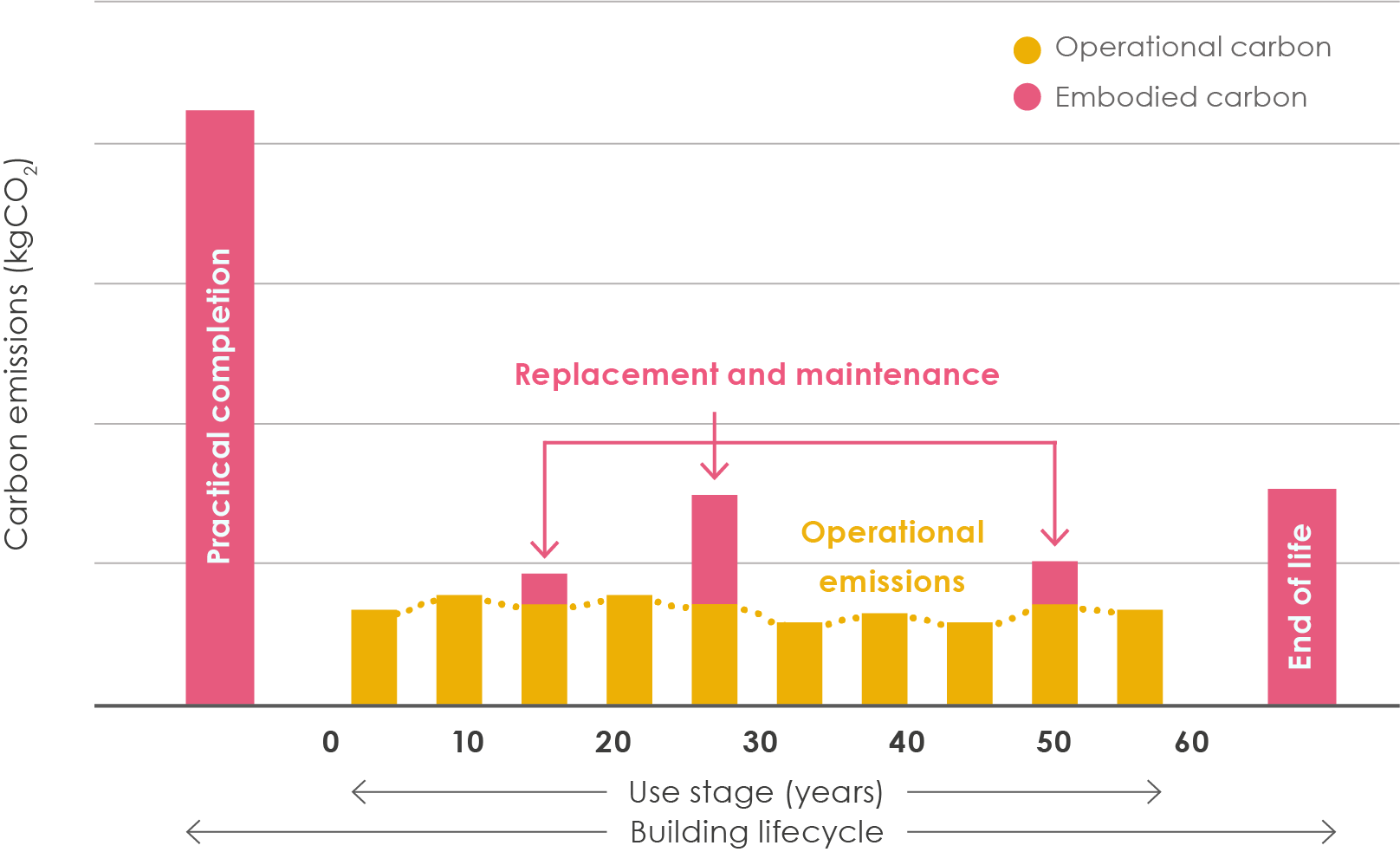

Real estate whole life carbon emissions are the carbon dioxide and other greenhouse gas emissions emitted over the entire life cycle of a building or infrastructure asset. This takes into account its operational emissions, such as energy consumption for heating, cooling, and lighting, as well as embodied emissions from its production, construction and eventual demolition or recycling.

More than half of embodied emissions occur in the upfront construction phase, representing almost a third of all emissions across the lifecycle of a building.

A WLC approach gives a more complete view of an asset's emissions, identifying opportunities for investors to act across the life cycle to lower its carbon footprint. For example, more than half of embodied emissions occur in the upfront construction phase, representing almost a third of all emissions across the life cycle of a building.

The interaction between operational and embodied emissions in a building across the building life cycle.

Investors are uniquely placed to influence each stage to lower a project’s carbon footprint and improve wider industry standards. Our guidance also details why operational and embodied emissions must be considered together but also differently, acknowledging their specific nuances.

The Net Zero Investment Framework, the most widely used guidance by investors who have set a net zero commitment today, encourages investors to begin setting and disclosing targets for their embodied emissions for new construction and retrofit activities, alongside operational emissions.

Setting minimum reporting requirements across all lifecycle stages is one way in which investors can improve the ability of the industry to address its carbon and resource footprint. The wider regulatory environment may also place more expectation on embodied carbon reporting over time, for example through the recast EU Energy Performance of Buildings Directive.

Developing internal processes

The second part of the guidance demonstrates internal processes that investors can consider to address WLC emissions systemically. These are listed as seven common challenges with rules to overcome them, structured around the various stages of the property and investment lifecycle.

Addressing whole life carbon represents a challenge but also an enormous opportunity to catalyse change in the sector.

These cover industry engagement; data improvement; governance; strategy; clearly defined metrics and reporting requirements; implementation, and routine review and realignment of targets. Our guidance also warns of the risks posed by overlooking these rules.

For investors committed to reaching net zero through real world emissions reductions, addressing whole life carbon represents a challenge but also an enormous opportunity to catalyse change in the sector. Integrating WLC into decarbonisation strategies can help not only to mitigate environmental impact but also protect the long-term resilience and value of those real estate assets.

At COP28 I will be leading and joining several discussions on this topic. IIGCC a member of the BuildingstoCOP coalition which has a dedicated stage at the conference. The hope is that this sparks new adoption which will ultimately improve sector standards and reduce its carbon footprint.

If you’d like to be the first to hear about IIGCC’s work at COP28 and access our webinars, insights and analysis, why not speak to our investor relations manager today to find out more about becoming a part of IIGCC?