Callum Provan

Content Strategist

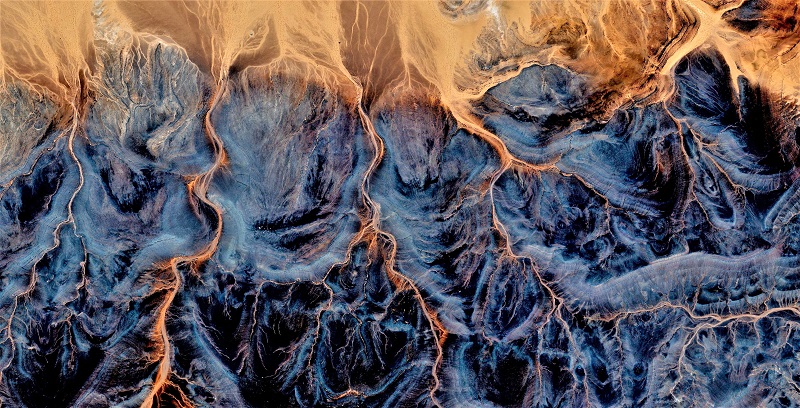

After the cost of living crisis, ‘natural disasters and extreme weather’ is considered to be the most severe risk facing the world in the next two years. Taking a 10-year view, six of the top 10 most severe risks relate directly to climate change.

The World Economic Forum (WEF) report also warns that present-day challenges are distracting leaders from the focus needed to limit global temperatures increases to 1.5°C, referred to by WEF as “climate action hiatus.”

As many investors will agree, the report warns that this will create even greater challenges ahead. In ten years’ time, failure to mitigate climate change and failure to adapt to its effects will become the most severe risks facing the world.

In this timeframe, biodiversity loss and ecosystem collapse also become a severe threat, reiterating the importance of the recently launched investor-led initiative, Nature Action 100.

The results are based on responses from 1,200 private-sector risk managers, public policy-makers, academics and industry leaders, and was co-published together with Marsh McLennan and Zurich Insurance Group.

Though not surprising to many in the industry, it serves as a further reminder that the consideration and management of climate change related risks is inextricably linked to investors’ fiduciary duty to their clients and beneficiaries. Climate disaster risk

Climate disaster risk

Those already factoring in the need for adaptation and resilience to physical climate risk in their portfolios will not be surprised to see natural disasters and extreme weather scored so highly.

IIGCC research demonstrates clear proof that climate disasters affect portfolios and the assets within them; be it through immediate, operational, supply- or value-chain disruption.

A number of members recently played a pivotal role in this working group, helping to produce a discussion paper on working towards a climate resilience investment framework.

Discussions on the topic featured heavily across New York Climate Week and COP27 in Egypt, with IIGCC experts on the ground to outline the methodology so far and reasoning behind it.

The broader discussion was supported by 50 firms representing $10 trillion in assets under management, who outlined their expectations that companies should be identifying and responding to physical risks.

New battlefronts

The report also outlines several other emerging challenges.

These include “new battlefronts” between natural ecosystems and green energy sources which can cause environmental degradation; and the trade-offs required between food security and nature conservation as food shortages and inflation affect supply chains.

There is also a closer look at water scarcity and the lack of overall cooperation on these international issues. It is, and is no doubt designed to be, a sobering read for anyone unfamiliar with the space.

Therefore, although not news to our industry per se, there is hope that these reports deliver a wider shock factor needed to stimulate public policy and create systemic change.

Until then, responsible investors will continue doing everything they can to decarbonise portfolios and make a real-world impact on the climate challenge in line with their fiduciary duties.

If you’d like to receive our weekly newsletters full of industry-leading research and analysis, find out more about becoming a member today.

Read the full WEF Global Risks Report 2023.